- #SMALL BUSINESS BOOKKEEPING EXCEL FULL#

- #SMALL BUSINESS BOOKKEEPING EXCEL SOFTWARE#

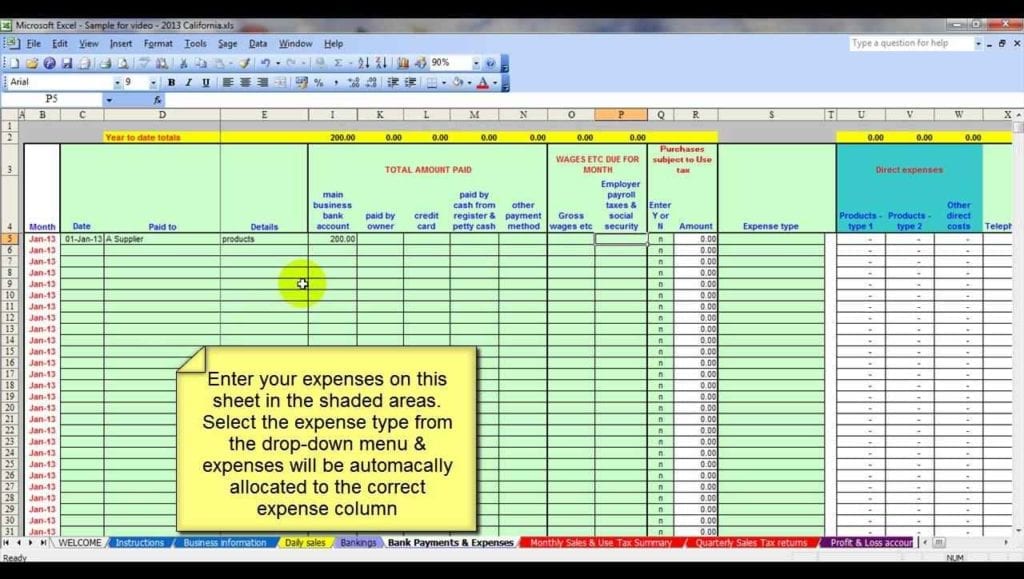

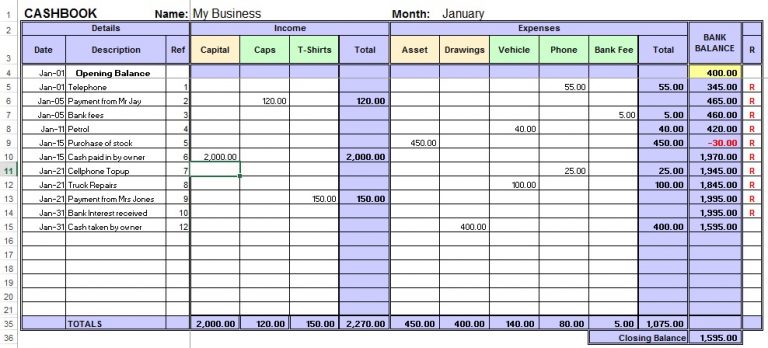

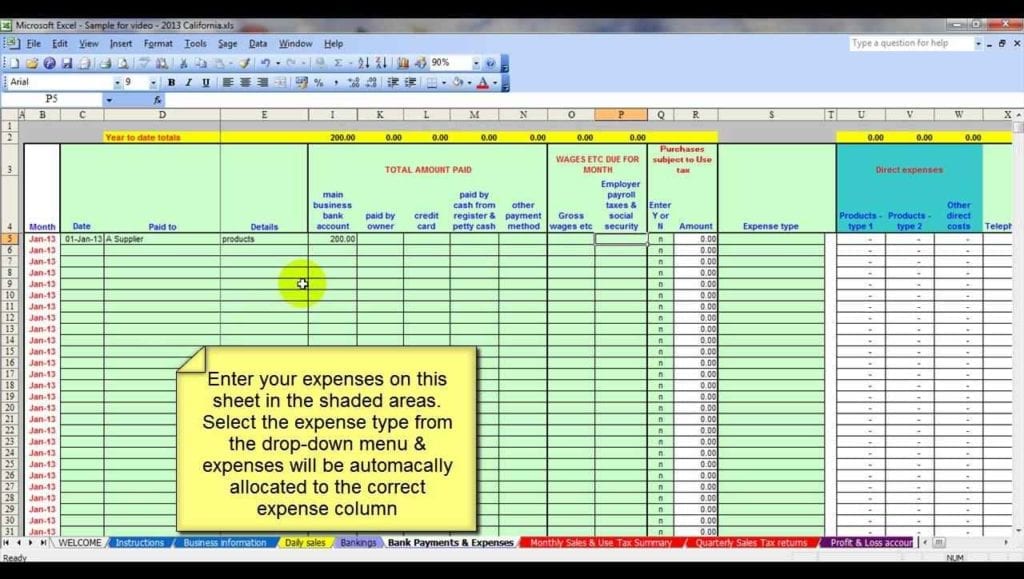

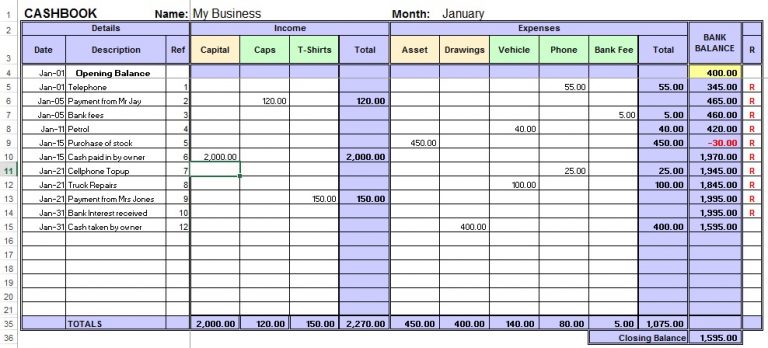

Assets = Liabilities + Shareholders’ (or Owner’s) Equity. The core principle of accrual accounting is the equation: Instead of simply recording cash flow, accrual accounting requires you to record all your assets and liabilities. While cash basis accounting is simpler, many businesses prefer accrual accounting because it gives them a fuller, more accurate picture of their company’s finances. Accrual accounting and the double-entry method You then record the check you received from the Johnsons, increasing the balance to $1100. You record your payment to Rosa’s Roses first and decrease your account balance by $150 to $600. For each transaction, the account balance is updated accordingly. This cash basis accounting example shows two transactions: one credit and one debit. Your Excel accounting might look something like this: You also need to collect a payment from the Johnson family. On that day, you need to pay the florist for the upcoming Johnson wedding. On July 8, 2021, you begin the day with $750 in your account. Your spreadsheet should have at least the following columns: But your fundamental accounting tracks money only when it changes hands. You can - and should - keep additional records of accounts payable (money you owe) and accounts receivable (money owed to you). Many small businesses prefer to use this system because of its simplicity. That’s all there is to cash basis accounting. They would regularly look over these lists to ensure that they always knew how much money they had available. They’d record income and expenses to their account. Once upon a time, people used to balance their checkbooks by hand. Along the way, I’ll also demystify double-entry (or dual-entry) accounting. I’ll discuss the difference between cash basis and accrual accounting. In addition to automating bookkeeping tasks, such as sending invoices (A/R) and paying bills (A/P), many programs use double-entry accounting, enable you to generate financial reports, provide some form of technical support, integrate with business apps, and can scale with your business.These are the most basic forms of accounting, and you can perform any of them by using Excel. #SMALL BUSINESS BOOKKEEPING EXCEL SOFTWARE#

While it can be done, it’s much simpler to use one of the many free accounting software that are available in both cloud and desktop formats.īasic bookkeeping software makes it easy to maintain detailed and accurate books. While there are many accounting uses for Excel, we don’t recommend using it as your primary bookkeeping software to track your cash flow and classify your income and expenses.

#SMALL BUSINESS BOOKKEEPING EXCEL FULL#

Select Enable Editing in Excel to view the full report. If you’re missing data when you open the report in Excel, it’s likely that the file is in a protected view. Ending Balance: It’s the balance of the loan after deducting the principal amortization.Principal Amortization: It’s the portion of installment payments that is deducted from the beginning balance of the loan.Interest: It’s the amount of interest expense based on the beginning balance of the loan.

This cell changes dynamically if you choose a payment frequency. Payments: It’s the installment payment you need to pay based on the payment frequency.Beginning Balance: It’s the balance of the loan at the beginning of the payment period.Date: It refers to the date when payment is due.For example, period 1 pertains to the first payment while period 6 pertains to the sixth payment. Period: It is the ordinal number corresponding to the number of payment periods.The amortization table contains the following information: Take note that the maximum loan term in this template is 40 years.

All you need to do is fill out the yellow cells and Excel will generate the table automatically. The template is a dynamic amortization table, and it adjusts based on the number of payment periods and terms.

0 kommentar(er)

0 kommentar(er)